advantages and disadvantages of llc for rental property

Ad Register a New Jersey LLC Online in 3 Easy Steps. Here are the three potential drawbacks of this solution.

![]()

Can I Put My Primary Residence In An Llc New Silver

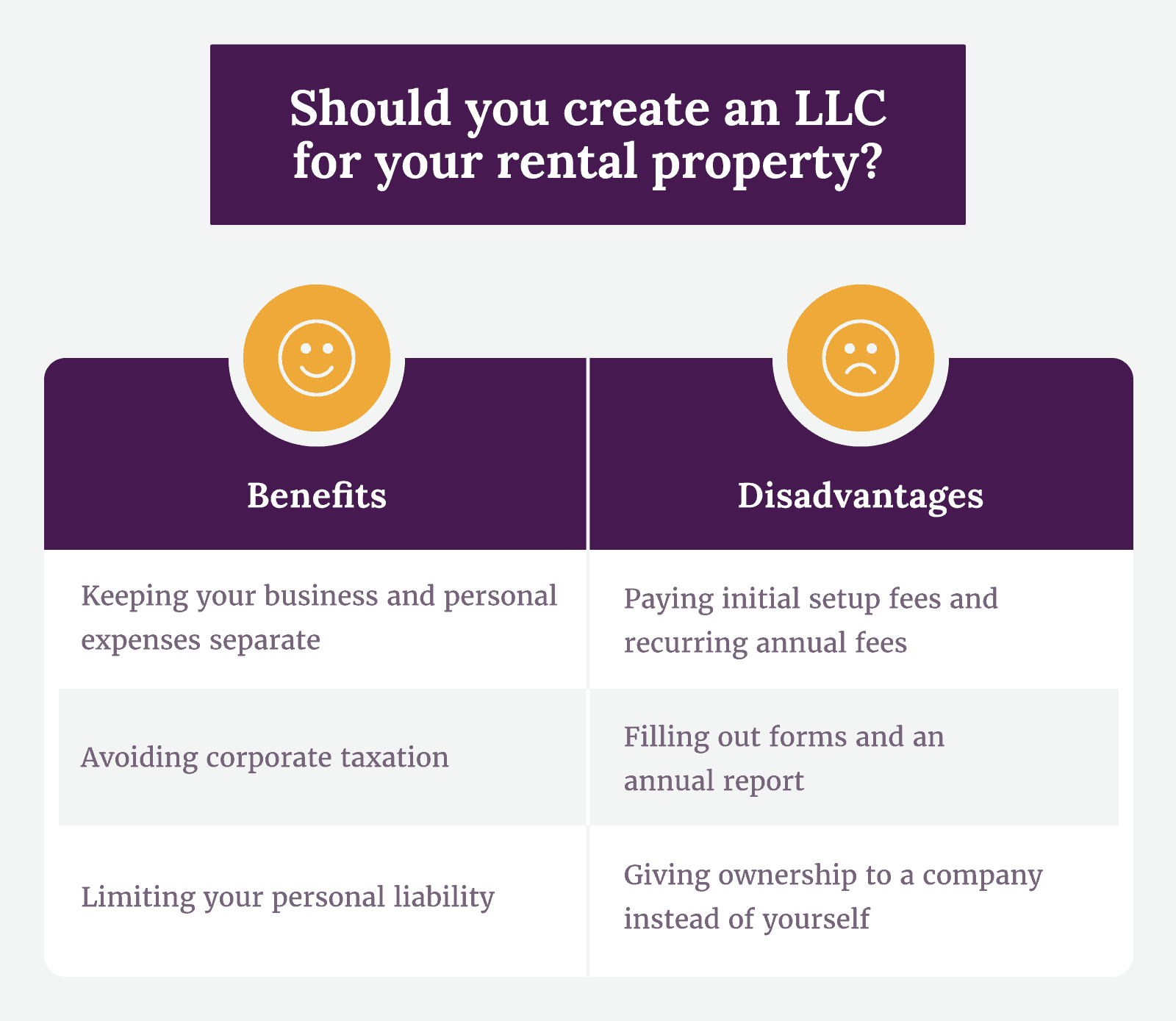

Pros of an LLC for rental property.

. Skip to content Menu Close. Rental properties provide passive income which is not much in the earlier years but can be lucrative in a long-term basis. The Advantages and Disadvantages of titling your Rental Properties into an LLC.

One of the major disadvantages of setting up an LLC for rental property is the upfront costs. We can help you get started. Depending on the state.

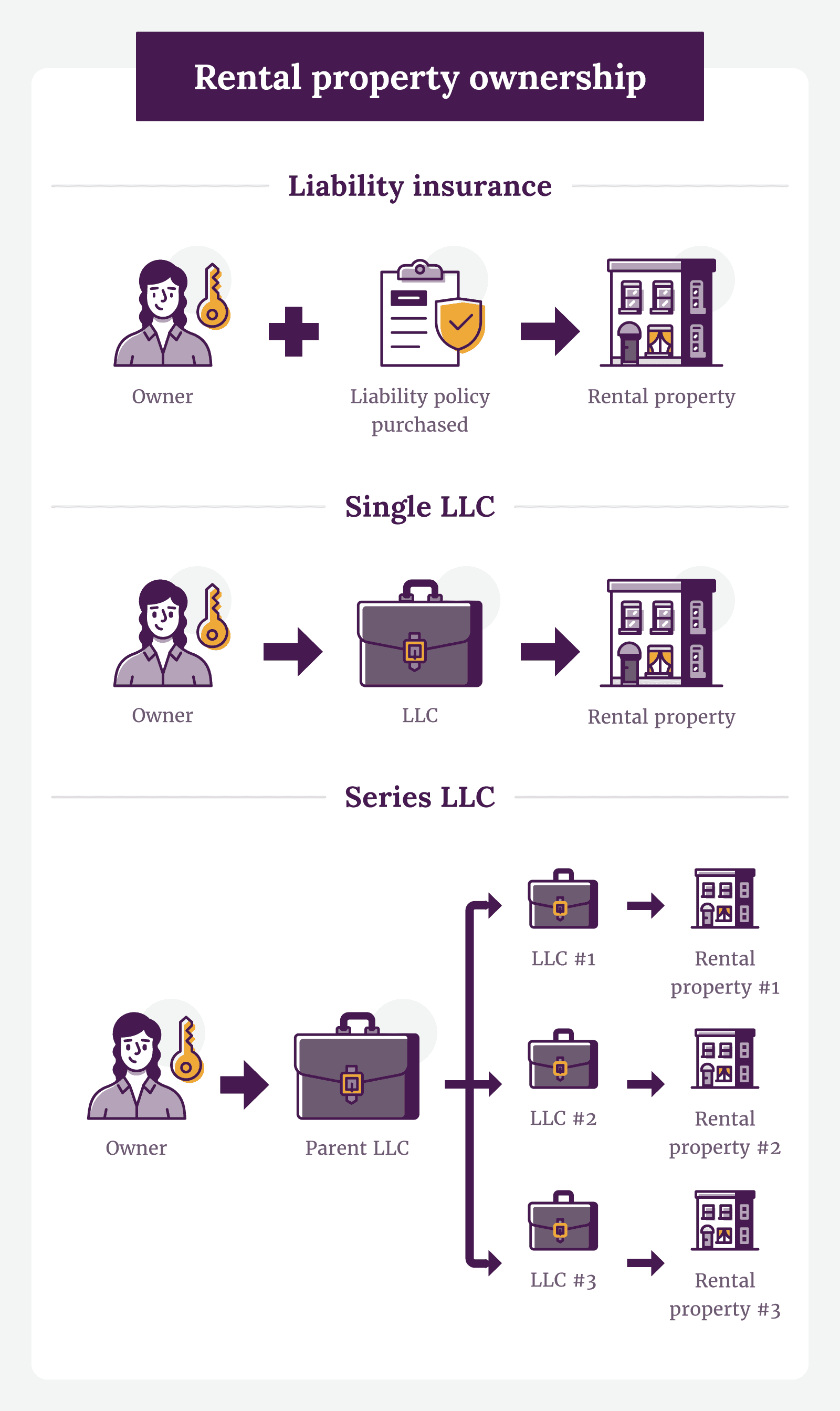

We offer services to help keep your LLC compliant like federal tax IDEIN licenses. In fact some real estate companies put each rental property in its own LLC as a subsidiary of the parent company. Three advantages to using an LLC for rental property.

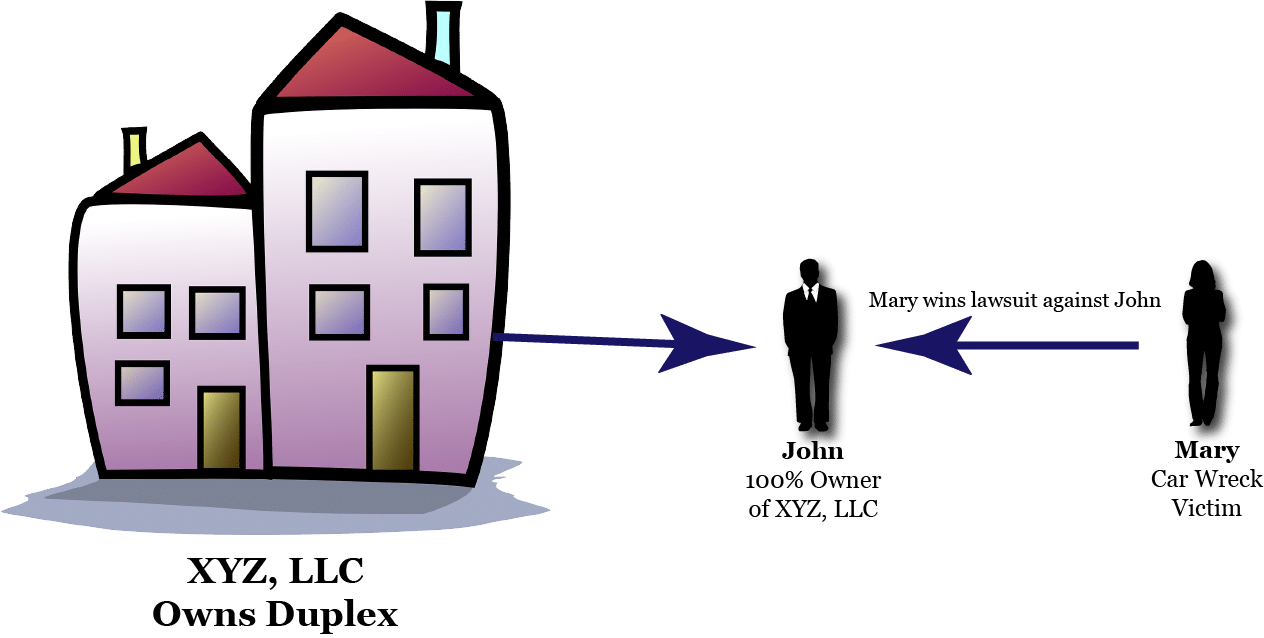

Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too. The advantages are the limited liability the nontaxable status of the LLC and. Lets say for example your LLC has the title to rental property.

The initial fees of creating an LLC for rental property are one of the main drawbacks. The aforementioned benefits come at a cost. Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC.

We offer services to help keep your LLC compliant like federal tax IDEIN licenses. The main reason investors prefer to have their rental properties in an LLC is for. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

The price of setting up an LLC varies depending on the state and can range from. We Have a Variety of Shapes and Sizes. It Costs Money to Register an LLC for Single Family Rental Properties.

Check out our Free LLC Self Filing Option. We can help you get started. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Advantages and Disadvantages of an LLC for Rental Property Another advantage of setting up an LLC for rental property is that it allows you to claim. Disadvantages of an LLC For Rental Property Businesses. The advantages and disadvantages to owning rental property in an LLC.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. Drawbacks of an LLC for Rental Properties. High Quality Customized LLC Kits Same Day Shipping.

Benefits of an LLC for a rental property. Rental properties can be financially rewarding and have numerous tax benefits including the ability to deduct insurance the interest on your mortgage and maintenance. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company.

Advantages and disadvantages of llc for rental property Wednesday March 2 2022 Edit. Real estate investors -just like every business owner- need to track their income and expenses so. Vast library of fillable legal documents.

Payment is not restricted to the owners of the LLC. Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. There are many advantages to establishing an LLC for your rental properties.

This means that a real estate LLC can have its own bank account have its own tax ID number and conduct real estate investing business all under its own name. One of the disadvantages of using an LLC for a real estate rental. Advantages of a Series LLC for Real Estate Investments.

Best tool to create edit share PDFs. Ad Start an LLC and protect your personal assets. Depending on your specific situation and unique circumstances the following may be considered pros for.

While there are many benefits to creating an LLC there are also quite a few drawbacks that make it a less advantageous option. If rental properties are part of your investment portfolio then. Ad Start an LLC and protect your personal assets.

Disadvantages of Forming an LLC. Some investors just dont have the patience to hold a rental. 1 Million customers served.

Lets turn to the potential disadvantages of forming an LLC. Here are some of the reasons certain investors and landlords choose to stay.

Llc For Rental Property Pros Cons Explained Simplifyllc

Lumi Nw Modern Prefab Homes Prefab Homes Prefab

Fsbo Right Or Wrong Tour Wizard Beach House Vacation Real Estate Photographer Beautiful Buildings

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Llc For Rental Property Pros Cons Explained Simplifyllc

Which Method Should I Use To Install My Engineered Wood Floor Engineered Wood Floors Plywood Subfloor Engineered Wood

12 Reasons To Use An Llc For Rental Property Under 30 Wealth

Top 12 Llc Advantages And Disadvantages Corporate Direct

Large Detailed Map Of Green Bay Detailed Map Map Green Bay

F A S T Can Handle Llc Business Entity Development Regardless Of How Complicated Or Simple Your Business N Llc Business Annual Report Estate Planning Attorney

Creative Charges Invoice The Guide To Pricing Commercial Photography Part 3 What Are You Worth Photography Invoice Commercial Photography Photography

Llc For Rental Property Pros Cons Explained Simplifyllc

Partnership Agreement Real Estate Forms General Partnership Contract Template Agreement

The Pros And Cons Of Putting Rental Property In An Llc Kmsd Law Office

Llc For Property Rentals In 2022 Company Finance Commercial Loans Opening A Bank Account

The Benefits Of Owning Real Estate In A Llc Pacaso

Comprehensive Guide All You Need To Know About Creating An Llc For Your Rental Property Wealth Nation